Wealth Management

Because your wealth is greater than the sum of its parts, we take a comprehensive approach to helping you manage it, dissecting all aspects of your assets, accounts, portfolios and other holdings in order to develop prudent growth and preservation strategies.

We offer a dedicated analytical team, a variety of investment disciplines in house, three dynamic model portfolios with favorable track records and a full spectrum of services – including, asset allocation, investment selection, personalized performance monitoring and reporting, alternative assets and private equity solutions, and more – to help meet the complex needs of successful families, executives, governments, municipalities and professional athletes.

Please contact one of our Wealth Management team members here to learn more.

Wealth Management Process

To help you define and achieve your long-term financial goals, we follow a comprehensive five-step process designed to help us get to know you and your objectives.

- Develop a clear understanding of who you are and define your goals

- Conduct thorough analysis with the use of a strong, well diverse financial team

- Work with senior management to tailor specific strategies given the current market and client risk tolerance

- Execute strategies and report in a timely manner to ensure client involvement in the process

- Monitor account performance and report results against appropriate indices and client goals

Investment Process

To address your growth and preservation needs, we take two approaches to investing that emphasize prudent strategy and team collaboration to help build an investment plan that makes sense for you.

Our equity and fixed income portfolio construction processes are based on a combined top-down, bottom-up selection process, utilizing research from investment partners while stressing team collaboration regarding market movements and fiscal issues.

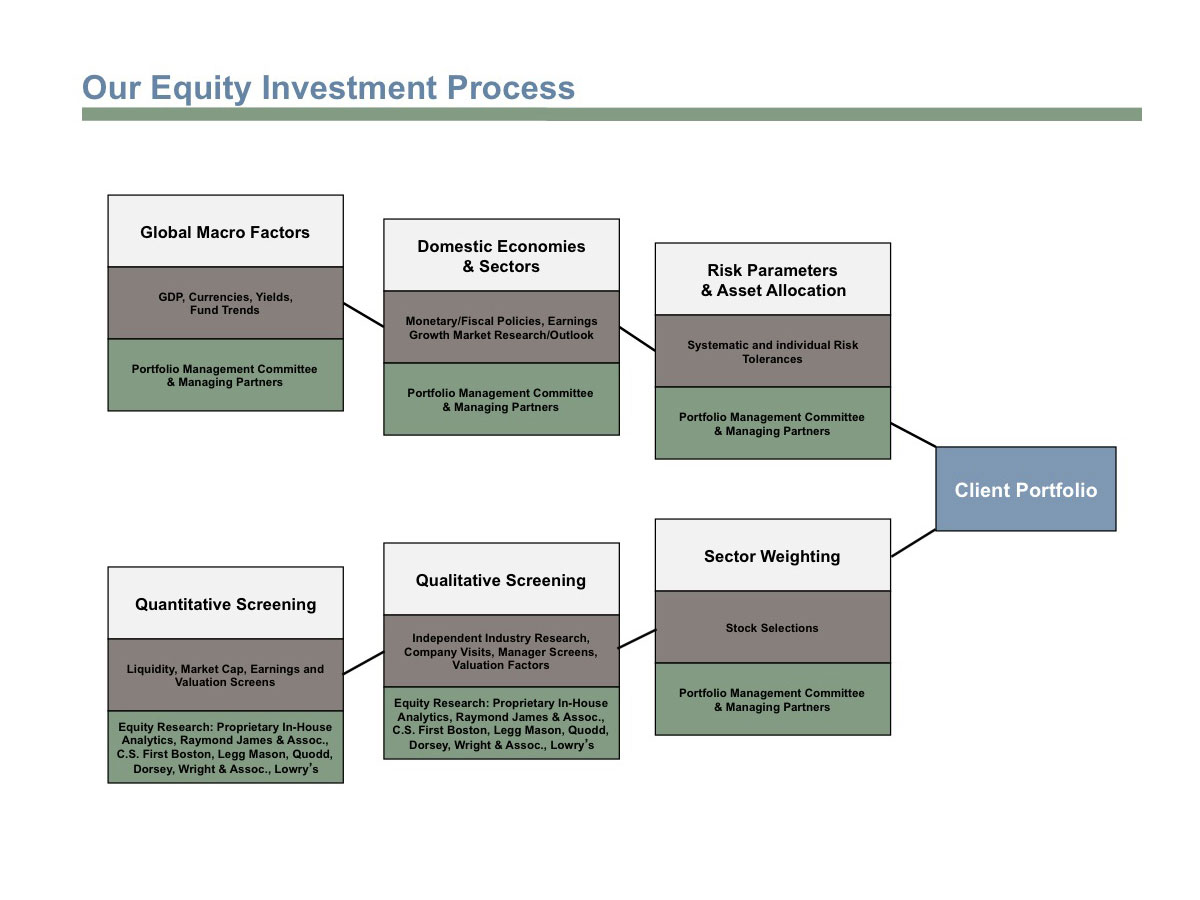

Our Equity Investment Process

AMB’s equity portfolio construction process is based on a combined top-down, bottom-up stock selection process, utilizing research from investment partners, while stressing a team collaboration regarding markets and fiscal issues.

Our Fixed Income Investment Process

AMB’s fixed income portfolio construction process is based on a top-down, bottom-up bond selection approach, utilizing research from investment partners, while stressing a team collaboration regarding markets and fiscal issues.

AMB Proprietary Investment Portfolios

Since inception, we have believed in differentiating ourselves from regional Investment Advisory Firms by creating and implementing model portfolio and proprietary investment disciplines. Through our Investment Strategists and our Research Analysts we offer multiple disciplines. Our disciplines include:

- AMB Model

The AMB model seeks capital appreciation and income with an emphasis on sector allocation, by selecting the strongest companies in the strongest sector groups. The investment strategy is not governed by traditional investment boundaries such as growth, income or large cap. The portfolio has the flexibility to invest in Exchanged Traded Funds (ETFs) and American Depository Receipts (ADRs) and may use cash to mitigate risk in the markets. - Core Equity Model

AMB’s Core Equity Model seeks to provide long term capital growth by investing in domestic stocks that appear to offer superior opportunities for growth of capital. The core exposure in equities blends value and growth styles of large cap companies. The portfolio has the flexibility to overweight sectors believed to outperform the index. The construction of the portfolio is based on top down approach. - ETF Model

The ETF Model utilizes some of the most innovative and cost effective financial products of the last twenty years, which are Exchange Traded Funds (ETF). These products make participation in a variety of stock “baskets,” sectors and/or indexes possible during market hours with one tradable instrument. - Fixed Income Model

The Fixed Income Model seeks a high and stable rate of current income, consistent with long-term preservation of capital. - Growth & Income Model

AMB’s Growth Income Model invests in stocks that are trading below their intrinsic values and have the potential to increase their earnings and free cash flow based on our fundamental research. The strategy seeks both growth of capital and income. The portfolio has the ability to invest in large cap stocks of both domestic and international equities. Equity portfolio construction is based on a top down/bottom-up process, and has the flexibility to overweight or underweight sectors based on the overall market outlook. - Select Growth Model

AMB’s Select Growth Model seeks capital appreciation through investment in Large Cap growth oriented companies. This strategy does not focus on sector allocation bur rather a bottom-up approach that looks for companies trading at a discount to our perceived growth rate. - Select Income Model

AMB’s Select Income Model focuses on high yielding companies with coverage ratios that are sustainable based on our cash flow projections. The strategy is concentrated, holding fewer than 20 companies. The portfolio has the ability to invest in large cap stocks of both domestic and international equities. Equity portfolio construction is based on a top down/bottom-up process, and has the flexibility to overweight or underweight sectors based on the overall market outlook.