Urology Sector Insights

APRIL 2022

APRIL 2022

The US urology market is highly fragmented with over 50 percent of practices serviced by one physician and less than ten percent of US practices having more than ten physicians

In 2020, 13,352 urologists were licensed in the US with approximately 85.7 percent providing patient care for at least 25 hours (“practicing urologist”)

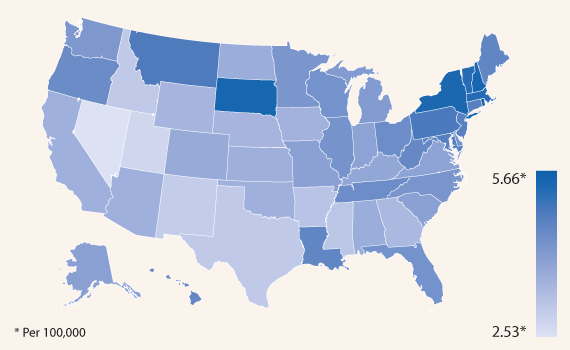

Of the US practicing urologists, 10.5 percent maintain their primary practice in non-metropolitan areas (in comparison to 20 percent of Americans living there, see graph below)

Telemedicine utilization increased substantially to 71.5 percent, up from 11.9 percent during 2019

Majority of new patients wait less than 3 weeks, whereas approximately 24 percent of patients wait for an initial appointment at least 4 weeks

| ~ $17.7B | Estimated 2020 US market size |

| ~ 393k | Average urologist salary |

| ~ 62% | US Counties lack a primary urologic practice |

| 51% | Of practicing urologists in private practices |

| ~ 18.8k | Average annual urologic patient cost |

1 American Urological Association

2 IBIS World

| Platform | Founded | Locations |

|---|---|---|

|

2020 | 179 |

|

2016 | 95 |

|

2018 | 24 |

|

2021 | 23 |

|

2020 | 21 |

AMB focuses on lower middle-market healthcare niches where consumerism and fragmentation meet to disrupt traditional healthcare channels. We typically advise companies with EBITDA of $5M to $20M and an average enterprise value of $100M. AMB’s research-oriented approach to business development has resulted in a vast network of strategic and financial sponsor relationships that yield industry leading intelligence and optimal outcomes for our clients.

Chief Executive Officer

843-405-1106 Direct

gordon.maner@ambwealth.com

Managing Director

843-501-2183 Direct

mikel.parker@ambadvisors.com

Managing Director

843-405-1108 Direct

ryan.loehr@ambadvisors.com

Vice President

843-371-8596 Direct

johnny.cross@ambadvisors.com