Telehealth Utilization Insights

JULY 2022

JULY 2022

With the pandemic loosening its grip, telehealth remains at levels significanly higher than pre-pandemic norms but uncertainly remains on where the "baseline" will shake out as volumes continue to decline.

Patient and provider exposure to telehealth models has been accelerated due to pandemic - leading to a favorable long-term tailwind as stakeholders become more familiar with hybrid care models and the enabling infrastructure behind it.

COVID-19 has helped break down traditional regulatory and financial barriers to for telehealth adoption, as the impact of the pandemic wanes there are concerns about the permanency of recent changes.

Despite public market concerns on the telehealth sector, M&A activity has sustained as a variety of healthcare stakeholders seek to expand patient/member touch points at compressed valuations compared to pandemic peaks.

Behavioral health telehealth usage continues at elevated-levels as providers and payers leverage telehealth to address the increasing prevalence of mental health illnesses exacerbated by COVID-19

With the pandemic loosening its grip, telehealth continues at levels significantly higher than pre-pandemic norms but uncertainty remains on where the “baseline” will shake out as volumes continue to decline.

COVID-19 catapulted mainstream demand for telehealth but despite surging demand, steady-state volume continues to decline from historic highs in 2020.

1 Fair Health NPIC database of more than 36 billion privately billed records

Telehealth has demonstrated an ability to service the needs of a variety of healthcare stakeholders, whether providing, receiving, or paying for care, multiple stakeholders stand to gain from the long-term adoption of telehealth.

1 Doximity State of Telemedicine, Second Edition

2 Optum Provider Telehealth Use and Experience Survey

COVID-19 has helped break down traditional regulatory and financial barriers to enable telehealth adoption, despite recent state and federal efforts stakeholders are still concerned about how payment parity, temporary modality flexibilities and licensing procedures will change post-pandemic.

1 Manatt Telehealth Response Tracking as of June 2022

Despite public market concerns on the telehealth sector, M&A activity has sustained as a variety of healthcare stakeholders seek to expand patient/member touch points at less frothy valuations.

| Date | Buyer/Investor | Target Name | Target Overview |

|---|---|---|---|

| June 2022 | SteadyMD | BlocHealth | Clinician licensing, credentialing and payer enrollment platform |

| April 2022 | Recuro Health | WellVia | Virtual primary care and behavioral health platform |

| April 2022 | Patient Square Capital | SOC Telemed | Acute care telemedicine platform |

| November 2021 | 23andMe | Lemonaid Health | Telemedicine and e-pharmacy platform |

| October 2021 | Ecolent Health | Vital Decisions | Telemedicine company specialized in end-of-life care |

| October 2021 | Well Health | WISP | Telehealth and e-pharmacy company specialized in Women’s Health |

| June 2021 | Accolade | PlushCare | Virtual primary care and mental health platform |

| May 2021 | Walmart | MeMD | Telehealth provider for common illnesses and behavioral needs |

| April 2021 | Cigna | MDLive | Telehealth provider across a broad range of services |

| April 2021 | Bright Health | Zipnosis | Telehealth software provider |

| March 2021 | Grand Rounds | Doctor on Demand | Consumer-facing telehealth provider across multiple services |

1 as of June 9th 2022

There has been a permanent shift in how patients receive behavioral health care as telehealth utilization remains significantly higher than pre-pandemic baselines.

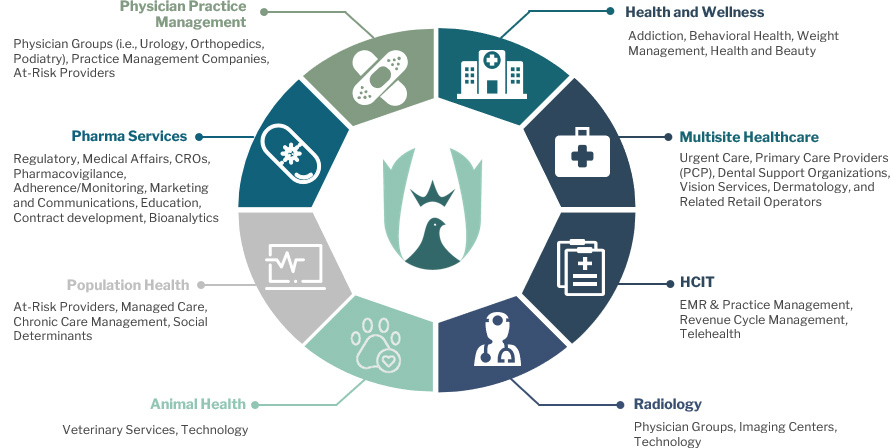

AMB focuses on healthcare niches where consumerism and fragmentation meet to disrupt traditional healthcare channels. AMB’s research-oriented approach to business development has resulted in a vast network of strategic and financial sponsor relationships that yield industry leading intelligence and optimal outcomes for our clients. We are currently most active in the following segments:

AMB focuses on lower middle-market healthcare niches where consumerism and fragmentation meet to disrupt traditional healthcare channels. We typically advise companies with EBITDA of $5M to $20M and an average enterprise value of $100M, but will move up and down the spectrum. AMB’s research-oriented approach to business development has resulted in a vast network of strategic and financial sponsor relationships that yield industry leading intelligence and optimal outcomes for our clients.

Managing Director

843-501-2183 Direct

mikel.parker@ambadvisors.com

Managing Director

843-405-1108 Direct

ryan.loehr@ambadvisors.com

Vice President

843-371-8596 Direct

johnny.cross@ambadvisors.com

Analyst

843-473-7981 Direct

kevin.williams@ambadvisors.com

Analyst

843-576-4709 Direct

sully.hagood@ambadvisors.com