Behavioral Health:

Insights

SEPTEMBER 2024

SEPTEMBER 2024

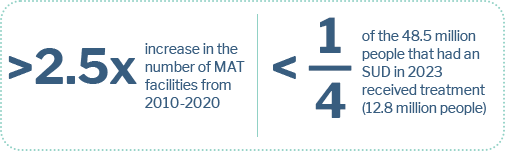

MAT is the use of FDA-approved medications, combined with counseling and behavioral therapies, to treat SUDs, including AUD and OUD. Sector growth is being driven by insurance coverage extensions, increased prevalence and government initiatives.

Sources: SAMHSA, CDC, Pitchbook, other publicly available sources

Sources: SAMHSA, CDC, Pitchbook, other publicly available sources

1 The undiagnosed and untreated population can expand the MAT market to $25 billion

2 Locations where people received treatment are not mutually exclusive (may report more than one setting) causing the total to exceed 132.8 million

Sources: SAMHSA, CDC, Pitchbook, other publicly available sources

| Date | Target | Acquirer | Transaction Type | |

|---|---|---|---|---|

| June 2024 |  |

Was acquired by |  |

Add-On |

| June 2024 |  |

Was acquired by |  |

Add-On |

| June 2024 |  |

Was acquired by |  |

Add-On |

| June 2024 |  |

Was acquired by |  |

Add-On |

| May 2024 |  |

Was acquired by |  |

Add-On |

| March 2024 |  |

Was acquired by |  |

Add-On |

| February 2024 |  |

Was acquired by |  |

Add-On |

| February 2024 |  |

Was acquired by |  |

Platform |

| February 2024 |  |

Was acquired by |  |

Add-On |

| February 2024 |  |

Was acquired by |  |

Add-On |

| February 2024 |  |

Was acquired by |  |

Add-On |

| February 2024 |  |

Was acquired by |  |

Add-On |

| January 2024 |  |

Was acquired by |  |

Add-On |

| January 2024 |  |

Was acquired by |  |

Platform |

| January 2024 |  |

Was acquired by |  |

Platform |

| December 2023 |  |

Was acquired by |  |

Add-On |

| November 2023 |  |

Was acquired by |  |

Add-On |

| November 2023 |  |

Was acquired by |  |

Platform |

Sources: SAMHSA, CDC, Pitchbook, other publicly available sources

The Modernizing Opioid Treatment Access Act (MOTA), introduced in Congress in March 2023, aims to streamline regulations to enhance opioid treatment. While it seeks to make it easier for providers to offer comprehensive care and promote MAT acceptance, concerns have been raised about its broader patient safety and care quality implications.

MOTA awaits action from U.S. Senate

Sources: SAMHSA, CDC, Pitchbook, other publicly available sources

This document is being provided in connection with an actual or potential mandate or engagement and may not be used or relied upon for any purpose other than as specifically contemplated by a written agreement with the Allen, Mooney & Barnes companies. This document is intended solely for the use of the party to whom it was provided to and is not to be disclosed (in whole or in part), summarized, reprinted, sold, redistributed or otherwise referred to without the prior written consent of the AMB companies.

Allen Mooney & Barnes Brokerage Services is a broker/dealer member of FINRA and SIPC. Allen Mooney & Barnes Investment Advisors, Inc. is an investment adviser registered with the U.S. Securities and Exchange Commission.

Information presented in this document is for informational, educational and illustrative purposes only. While the information in this document is from sources believed to be reliable, the AMB companies make no representations or warranties, express or implied, as to whether the information is accurate or complete and assume no responsibility for independent verification of such information. In addition, the analyses in this document are narrowly focused and are not intended to provide a complete analysis of any matter.

Past performance is not necessarily indicative of future performance. Estimates, projections or indications of future performance can be identified by certain statements, such as "believes," "expects," "may," "will," "should," "seeks," "approximately," "plans," "estimates" or "anticipates" or the negative of those words or other comparable terminology, as well as by statements concerning projections, future performance, developments, events, revenues, expenses, earnings, run rates and any other guidance on present or future periods. Any such statements are forward-looking in nature and involve risks and uncertainties. Any statements of future performance are based on assumptions that might not be realized and a number of factors, including without limitation, the volatility of the securities markets, the overall environment for interest rates, risks associated with private equity investments, the demand for public offerings, activity in the secondary securities markets, competition among financial services firms for business and personnel, the effect of demand for public offerings, available technologies, the effect of government regulation and of general economic conditions on our own business and on the business in the industry areas on which we focus and the availability of capital to us. We are under no obligation to update the information presented in this document or to inform you if any such information turns out to be inaccurate or misleading.

The information in this document is not, and is not to be construed as, an offer or a solicitation to buy or sell any securities or any other financial instruments or a recommendation or endorsement to engage in or effect any particular investment or transaction. Moreover, under no circumstances should the information in this document be considered legal, tax or accounting advice or relied upon, therefore. The recipient is advised to rely on the advice of its own professionals and advisors for such matters and should make an independent analysis and decision regarding any transaction based upon such advice.

The information in this document is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or for any distribution or use that would subject the AMB companies to any registration requirement within such jurisdiction or country.

677 King Street, Suite 410 | Charleston, SC 29403

AMB focuses on lower middle-market healthcare niches where consumerism and fragmentation meet to disrupt traditional healthcare channels. We typically advise companies with EBITDA of $5M to $20M and an average enterprise value of $100M, but will move up and down the spectrum. AMB’s research-oriented approach to business development has resulted in a vast network of strategic and financial sponsor relationships that yield industry leading intelligence and optimal outcomes for our clients.

Managing Director

843-501-2183 Direct

mikel.parker@ambadvisors.com

Managing Director

843-405-1108 Direct

ryan.loehr@ambadvisors.com

Vice President

843-371-8596 Direct

johnny.cross@ambadvisors.com

Senior Associate

843-473-7981 Direct

kevin.williams@ambadvisors.com

Associate

843-576-4709 Direct

sully.hagood@ambadvisors.com

Analyst

843-405-1112 Direct

josh.hall@ambadvisors.com

Analyst

405-343-1643 Direct

asha.hamaker@ambadvisors.com

Analyst

843-271-5652 Direct

brayden.sarathy@ambadvisors.com