Behavioral Health:

ABA Therapy

INDUSTRY SUMMARY

INDUSTRY SUMMARY

ABA Therapy is a mature scientific discipline that focuses on the analysis, design, implementation, and evaluation of social and other environmental modifications to produce meaningful changes in human behavior.

The ABA therapy market is expected to grow at a 4.5% CAGR over the next 3-5 years, however, the needs of the growing ASD population remain grossly underserved.

1 CDC prevalence report is released biennially, using the results from 4 years prior

Sources: Publicly available data

Current supply of clinicians is insufficient to meet growing demand for ABA therapy services as an estimated 100,000 BCBA are needed to serve the ~1 million children with ASD in the U.S., but only 30,000 are available.

1&2 Sources: Publicly available data

3 Deal count # in actuals

Due to better understanding and education around ABA therapies there has been increased diagnosis of behavioral health disorders among Americans and recognition of the economic burden it creates.

Children with ASD have steadily increased over the past 2 decades from 1 in 150 in 2000, to 1 in 44 as of 2022

Increased recognition of the benefits of early intervention and intensive therapy on children with ASD

All 50 states in the U.S. now require mandatory insurance coverage for ASD for state-sponsored plans, compared to 38 in 2014

Investors are able to better negotiate rates with payors, recruit additional providers, and build a strong brand presence

Top 9 players only account for 27% of revenue, while the remaining portion of the market is largely fragmented across smaller players

ABA market is relatively more stable with less stringent regulatory headwind

Sources: Publicly available data

ABA and ASD have been synonymous for years now, but research highlights ABA’s applicability to several other behavioral issues outside of ASD alone.

ABA treatment is widely recognized as the most effective method for treating ASD, but its evidence-based treatment methods are applicable beyond ASD alone

All 50 states across the U.S. require insurance coverage for ABA as it relates to ASD. However, whether insurance will cover ABA therapy without an ASD diagnosis varies state to state

Mental health issues in schools and the provision of more providers will ultimately expand ABA recognition beyond ASD exclusively

The current macroeconomic uncertainty and labor shortage will delay the aforementioned expansion. 2022 began with 10 million job openings and 7 million unemployed

Attention- Deficit/ Hyperactivity Disorder ABA therapy can help children with ADHD interact appropriately with others.

Obsessive Compulsive Disorder ABA therapy can help children with OCD cope with their disorder to prevent disruptions in daily life.

Oppositional Defiant Disorder ABA therapy can benefit children with ODD by conditioning them to act in healthier ways and discouraging them from the negative behavior characterizing the disorder.

Post-Traumatic Stress Disorder ABA therapy isn’t the only therapy needed to treat PTSD, but it is beneficial in reducing the negative reactions to the memories.

Panic Disorder ABA treatment for panic disorder will likely utilize behavioral activation, or BA. The idea is to teach the client that behavior can affect mood, giving them more control over their attacks.

Sources: Publicly available data

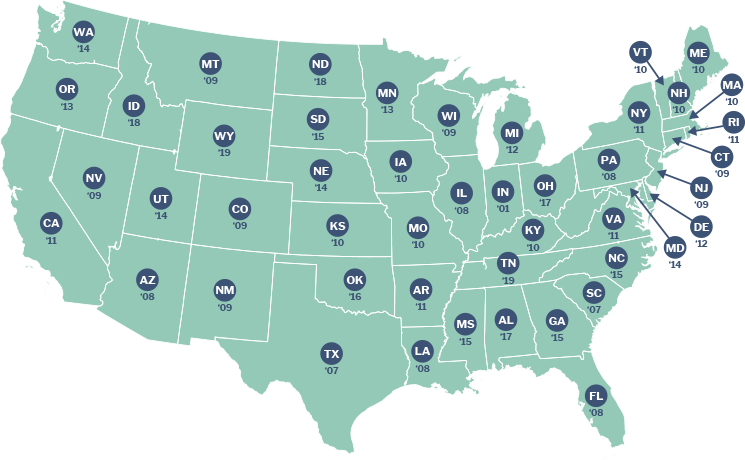

Over the past two decades all 50 states have taken action to require meaningful coverage for treatment of ASD in state-regulated health plans. As it currently stands, ABA regulations focus almost exclusively on ASD.

All states require coverage for ABA, however, some states limit this coverage based on age, dollar or hour caps

Some state ASD insurance laws exempt or "carve out" one or more plan types from coverage requirements

Fully insured plans are subject to laws in the state where they are issued, not necessarily where the beneficiary resides

2008

Prevents group health plans and health insurance issuers that provide mental health or substance use disorder (MH/SUD) benefits from imposing less favorable benefit limitations on those benefits than on medical/surgical benefits

September 2019

Under the Autism CARES Act of 2014, > $3.1bn was dedicated for ASD throughout various agencies; the CARES Act of 2019 authorizes an additional $1.8bn over the next five years

December 2020

Requires that group health plans prepare a detailed, written comparative analysis for each of the plan’s nonquantitative treatment limitations (NQTLs)

Sources: Publicly available data

The industry is very fragmented with few larger players, creating opportunities to drive growth through M&A and de novo expansion.

| Company | Inception | Funding/Backing | Locations | Employees | Services/Treatment |

|---|---|---|---|---|---|

|

1990 | Acquired by Blackstone in 2018 | 24 States (221 locations) |

2,531 |

|

|

2005 | Acquired by Moran Capital Partners in 2015 | 12 States (172 locations) |

810 |

|

|

2017 | KKR formed in 2017 | 17 States (>160 locations) |

575 |

|

|

1988 | Acquired by FFL Partners in 2017 | 20 States (128 locations) |

1,391 |

|

Sources: Publicly available data

AMB focuses on lower middle-market healthcare niches where consumerism and fragmentation meet to disrupt traditional healthcare channels. We typically advise companies with EBITDA of $5M to $20M and an average enterprise value of $100M, but will move up and down the spectrum. AMB’s research-oriented approach to business development has resulted in a vast network of strategic and financial sponsor relationships that yield industry leading intelligence and optimal outcomes for our clients.

Managing Director

843-501-2183 Direct

mikel.parker@ambadvisors.com

Managing Director

843-405-1108 Direct

ryan.loehr@ambadvisors.com

Vice President

843-371-8596 Direct

johnny.cross@ambadvisors.com

Analyst

843-473-7981 Direct

kevin.williams@ambadvisors.com

Analyst

843-576-4709 Direct

sully.hagood@ambadvisors.com